we believe in the

power of up.

In 2020, we changed our name to Ascendus to reflect a new vision. One that focuses on creating not just financial inclusion, but financial ascension for all. Our clients need truly transformational services. In addition to access to capital, they need support, counseling, and mentorship to ascend the systemic pitfalls they face due to income, race, gender, and country of origin.

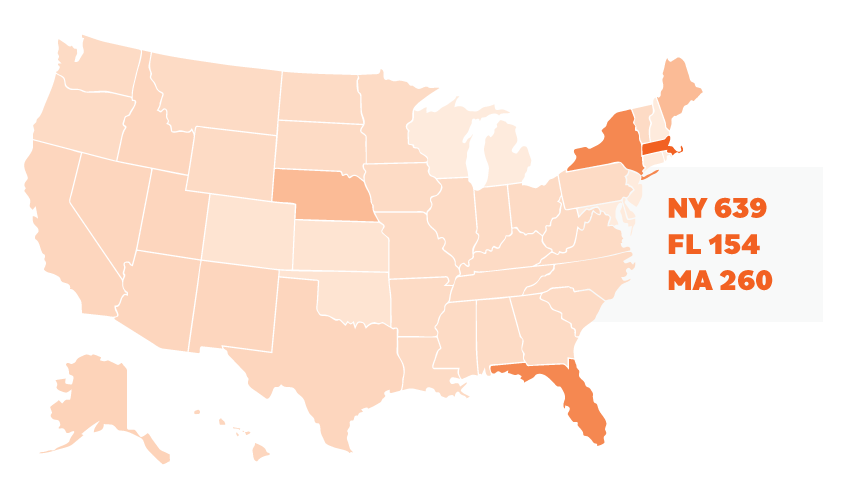

Ascendus believes in the bold vision of creating financial ascension for those who have been systemically excluded from financial opportunity. For over 30 years, we’ve provided small business owners – primarily BIPOC, women and immigrants – with the tools to move up, improve their lives, care for their families, and contribute to their communities. We’ve placed over $200 million into the hands of 24,000 small businesses through our programs in New York, Massachusetts, Florida and nationally.

Board Chair and CEO Letter

In 2020, we changed our name to Ascendus to showcase the bold upward shift in our vision. Financial inclusion is no longer enough. Today, we seek to create a world of financial ascension for all.

For over 30 years, Ascendus has empowered low-to moderate- income business owners through access to capital and business support in communities that need it most. In 2020 alone, we delivered critical financial resources to over 6,100 entrepreneurs who were at risk due to the unprecedented challenge of the COVID-19 pandemic. Amid our shift toward a new vision and name, the pandemic forced us to reflect on how to advance during this once-in-a-century moment.

Our answer was to remain focused on our core values and mission. Our value of ‘dedication’ fueled our drive to ensure our clients received financial help to survive. Our value of ’empathy’ inspired our automatic, no-questions-asked deferment of loan payments to nearly 1,000 clients, as well as our shift to grants, forgivable loans, and low-cost debt. At a national level, we advocated for clients by testifying before the U.S. Senate’s Subcommittee on Small Business and Entrepreneurship for additional COVID-19 relief resources and the extension of the Paycheck Protection Program (PPP).

Our value of ‘inclusion’ enabled us to quickly partner with others to create a collective response to the pandemic challenge. We partnered to disburse over $32MM in forgivable PPP loans to over 2,700 businesses. We co-created and implemented special-purpose vehicle (SPV) programs that lent recovery funds across seventeen states. We partnered with a national nonprofit organization to approve $30MM in grants to small businesses across the United States.

The pandemic required everyone to pivot to manage change, testing our value of ‘adaptability’ to ensure we created new solutions for current market conditions. This led to the launch of the $1.2MM Restaurant Futures Fund, which not only supports the restart of restaurants, but seeks to improve the food service workplace. To create some certainty during uncertain times, we launched our line of credit product, which provides an evergreen source of liquidity for short-term, recurring, and non-capital needs. We believe this product will transform the impact of our work in the years to come.

Our new journey towards ascension has just begun. In 2022, Laura Miller will become our new board chair, succeeding Dennis Lagueux, who has led the board with distinction for nine years. Our focus on ascension means that we will be dramatically enhancing how we measure progression, to ensure our work is transformational, and not merely transactional.

With your support and because of our shared belief and pursuit of The Power of Up! Ascendus will continue to be a place where small business owners succeed. Thank you for being a part of our road to ascension. We look forward to continuing our journey into the future, together.

our values

Ascendus is guided by six core values:

inclusion

We create community. We value the contributions of every person.

adaptability

We are innovators; we continually improve ourselves and our world. We take risks to do so.

empathy

We walk in others’ shoes. We know that true understanding must occur at an emotional and intellectual level.

integrity

We earn trust by making promises – and keeping them.

passion

We are proud about being Ascenders; we work to honor our values in everything we do.

dedication

We give 100% at all times. We are committed to Ascendus, our mission and our clients.

whom we served in 2020

1,101

businesses in

25

states

74%

immigrants

65%

entrepreneurs of color

56%

women

55%

low- to moderate-income households

2020 outcomes

In 2020, we provided over $56MM in COVID-19 relief loans, grants, and payment flexibility to help 9,800 small business owners and their families survive.

In response to overwhelming need in 2020, we lent over $18MM in COVID-19 relief loans to 1,317 clients, $3MM more than we did just one year ago, making 2020 the most impactful year in our 30-year history.

Our goal since the onset of the pandemic has been to stem the tide of losses, focusing primarily on two goals: business survival and job retention. With support, our clients saved 2,500 local jobs in 2020.

We wanted our clients to have flexibility, and to keep cash in their pockets, so we deferred $6.1MM in debt for 1,000 clients.

We understood that our clients needed flexibility, loan forgiveness and low interest loans. Over 50% of our loans last year were forgivable or had interest rates below 2%.

Cash was key to business survival, so we worked with partners to unlock $32MM in relief grants to 2,700+ businesses.

We wanted to ensure that our clients got all the help they needed. We delivered 13,900 hours of support and advice to 5,900 clients.

it starts with bridging the gap.

ACCESS TO CAPITAL

Ascendus provides small business owners with the affordable and accessible business loans they need to start or expand their business.

FINANCIAL EDUCATION

SUPPORT SYSTEMS

Clients have access to networks of support, including in-depth mentorship and peer networking events, that provide them with insight on growing their business.

FINANCIAL ASCENSION

Ascendus’s Paycheck Protection Program Provided $33 Million to the Hardest-to-Reach Communities

Creating an Innovative Lending Model through the New York Forward Loan Fund

Designed in partnership with the New York governor’s office and five hand-picked mission lenders that included Ascendus, the New York Forward Loan Fund was designed to support small businesses in New York State in desperate need for disaster relief. Launched in May 2020, the program has provided $86.6 million in loans to more than 1,500 businesses statewide, nearly two-thirds to minority- and women-owned businesses, through short term relief and long term recovery, in one of the toughest periods in New York’s history. Ascendus has provided over $8 million to 286 small businesses through the program.

Ascendus’s Paycheck Protection Program Provided $33 Million to the Hardest-to-Reach Communities

Ascendus was a lender in the Small Business Administration’s signature COVID relief program for small businesses – the Payment Protection Program. These SBA-backed loans were a crucial lifeline for small businesses, in large part because they were 100% forgivable if the funds were used for eligible expenses such as payroll.

Through the lifetime of the PPP program, Ascendus provided over $33 million in PPP loans to 2,300 small business owners. We extended this resource to the smallest businesses nationwide – our average loan size was just $14,000, compared with $101,000 nationally. Seventy percent of our PPP borrowers were entrepreneurs of color, 70% were self-employed, and over half were immigrants or use English as a second language.

Ascendus Receives $1 Million from the Citi Foundation to Provide COVID-19 Relief Programming

In May 2020, economies closed, hospitals filled with patients, and businesses were forced to close their doors. Citi’s Small Business Relief Program enabled CDFIs to serve small, diverse entrepreneurs who might not qualify for federal government stimulus funding. The timing and size of this support were critical for ensuring mission continuity for Ascendus.

Ascendus Launches First Ever 15+ State Collaborative to Bring COVID Relief to the South

Ascendus Launches First Ever 15+ State Collaborative to Bring COVID Relief to the South

The Southern Opportunity and Resilience (SOAR) Fund brings together a diverse group of community lenders to help small business owners across the South access COVID relief resources. The program reaches the smallest of small businesses and those that have been historically underbanked, including those in rural areas and those owned by women, people of color, and immigrants.

Ascendus disbursed the first loan of this historical program in May 2021. Since then, we have provided over $1.9 million to 53 borrowers, 75% of whom are minority-owned businesses.

Ascendus Brings Relief Model to the State of Washington

Ascendus Creates a 0% Loan Fund for Restaurants Focused on Equitable and Safe Workspaces

Launched in partnership with The Restaurant Workers Community Foundation, the loan fund provides 0% interest loans to restaurant owners focused on building just and pro-labor businesses. These critical resources are supporting businesses that are trying to empower their workforces in an immensely difficult operating environment. We’ve been able to provide over $596,000 to 15 restaurant owners across eight states.

Ascendus Brings Relief Model to the State of Washington

The Small Business Flex Fund, supported by the Washington State Department of Commerce, works with local Community Development Financial Institutions (CDFIs) to reach under-resourced communities and underbanked businesses. Since the program launched in the summer of 2021, we’ve provided 19 business owners with over $1.2 million in capital.

Ascendus Provides Relief Resources for Miami through the RISE Miami-Dade Loan Program

As COVID-19 put considerable economic pressure on small business owners everywhere, the RISE Miami-Dade Loan Program kicked off an explosion of lending activity to address the needs of Miami’s small businesses in late 2020. The program put $20 million in low-cost loans in the hands of 900 Miami businesses, investing in the survival of critical jobs, goods, and services. Of that total, Ascendus lent $4.6 million, or 24% – far exceeding our previous records for dollars lent in Florida statewide, let alone in Miami. Over 75% of clients were entrepreneurs of color, 39% were women, and only 12% had received technical assistance support like financial counseling within the last two years.

Ascendus Received $2 Million through the Wells Fargo Open for Business Program

Ascendus Received $2 Million through the Wells Fargo Open for Business Program

Ascendus is proud to be the recipient of a $2 million grant through the Open for Business Program–an industry-leading commitment from Wells Fargo to donate approximately $400 million from their own PPP lending. Wells Fargo support allowed Ascendus to help create a best-practice COVID relief program serving minority-owned businesses across Massachusetts. We’ve deployed nearly $1.2 million to over 100 business owners – all of whom are entrepreneurs of color.

addressing the need

Our work is focused on addressing systemic challenges to entrepreneurs of color and women.

access to capital

White families hold 8x more wealth than Latinx families and 10x more wealth than Black families.

Equal Access

At every level, Black and Latinx individuals, women, and immigrants have been excluded for decades from critical financial resources to support economic mobility.

Financial health

57% of Black businesses and 49% of Latinx businesses qualify as “at-risk” or “distressed” compared to 27% of their white counterparts.

COVID-19 Relief

Small businesses in communities of color are approved for COVID relief funding at half the rate of white communities.

SBA South Florida District Office Mission Based Lender Award

Through the Small Business Week Awards Ceremony in Florida, we received the Mission Based Lender Award for our total of microloans and community advantage loans.

CDFI Fund’s Financial Assistance (FA) Award

For the eighth time in 9 years, we received a Financial Assistance Award through the CDFI Fund. One of the most competitive awards nationwide for our field, this award is a testament to our scale, impact, and leadership in empowering the most financially marginalized entrepreneurs.

Number 1 Microlender for Volume of Loans in Massachusetts

Ascendus provided COVID relief to Massachusetts small business owners through 46 SBA microloans totaling almost $315,000 in capital.

what your support means

With your support, we can provide the resources needed to help our clients on the road toward financial ascension. These resources are important during the COVID-19 pandemic and continue to be necessary during the recovery. Thank you for supporting small business owners and their communities.

thank you to our 2020 Ascendus supporters

Institutional Partners

Amerant Bank

Anonymous

Apple Bank

Bank Leumi

Bank of America Charitable Foundation

Bank United

DIME Community Bank

Boston Private Bank & Trust Company

Brooklyn Community Foundation

Capital One

Citi Foundation

Comerica Charitable Foundation

Community Development Financial Institutions Fund

Credit Suisse Americas Foundation

Deutsche Bank Americas Foundation

Eastern Bank Charitable Foundation

Empire State Development

Fifth Third Bank

First Republic Bank

FJC – A Foundation of Philanthropic Funds

Friedman Family Foundation

Hiscox USA

HSBC Bank USA, N.A.

Investors Bank Charitable Foundation

Joseph H. And Florence A. Roblee Foundation

HAB Bank

JPMorgan Chase Foundation

Massachusetts Growth Capital Corporation

Metropolitan Commercial Bank

Morgan Stanley

Moses Kimball Fund

MUFG Foundation

New York City Council

New York Community Bank Foundation

PCPC

People’s United Bank

Popular Foundation

Pritchard Charitable Trust

Restaurant Workers’ Community Foundation

Rita J. & Stanley H. Kaplan Family Foundation

Roy A. Hunt Foundation

Santander Bank

Signature Bank

Square

Sterling National Bank

TD Bank, NA

TD Charitable Foundation

The Boston Beer Company

The Boston Foundation, Inc.

The Chicago Community Trust

The Clark Foundation

The Dayton Foundation

The Delores Barr Weaver Family Endowment Fund 1

The Ford Foundation

The Hispanic Federation

The Hyde & Watson Foundation

The Lawrence Foundation

The Mabel Louise Riley Foundation

The Miami Foundation

The Mizuho USA Foundation, Inc.

The New York Community Trust

The Paul And Edith Babson Foundation

The Robin Hood Foundation

The Schwab Charitable Fund

The Vidda Foundation

TIAA Bank

US Small Business Administration

Wells Fargo Foundation

Individual donors

Joel Abrams

Heath Adler

Annette E. Alvarez

Anonymous

Jeffrey Ashe

David Asher

Akshata Bailkeri

Janie Barrera

Benjamin & Susan Baxt

Jonathan Bello

Berman Aries Family Charitable Fund

Andre Boykins

Jane Campbell

Anne & Joseph Cerami

Alan Cody & Edith Moricz

Coco Corona

Jerry and Lynn Crane

Jessica Daniels & Paul Blackborow

Daniel Delehanty*

Clara Diaz-Leal

Del Domke

Carmen Duperon

Jason Eastep

Andrew Epstein

Fabiana Estrada

Jessica Galimberti

Colleen Galvin*

Jonathan Gold

Eva Greger Morse

Ana Hammock & Jeffrey Isen

Carol Hunt

Andrea Ierace

Chris Jones

Florence Julliard

Eleanor, Rebecca & Annie Katz

Ben Katz

Dennis & Pauline Lagueux

Andrew & Lily Leavitt

John Lockhart

Holly & Charlotte Longworth

Eva Lyon

Al Martinez-Fonts

Abby Mayerhoff

Adam Molina & Christa Blomquist

Cheryl Myers & Steve Stockton*

Benjamin Nissan

Ellen Phillips

Dr. Jacqueline &Jean Paul Plumez

James Robbins

Barbara Romani

Ann Scharpf

Ilya Scheidwasser

Allison Sellers

Cristina Shapiro*

Ari Shaps

Brett Simmons

Charles Smith

Jennifer Spaziano

Henrik Totterman

Helen Vanco

Joshua Walshe

Diana Waterbury

Jerome Weiss

Ashley Wessier & Sherri Lane

James Wong

Bert Woodruff & Barbara Bilson

Julie & Harold Bordwin

Karen Schmitt

Karla Gottlieb

Kate Novotny Angeles

Katherine Kiernan

Katherine Watts

Kathleen McQuown*

Ketty De La Cruz

Kevin Fisher

Lara Porter

Laura Miller*

Lauren Yothers

Leo Toca

Leonardo Acosta

Leslie Puth

Lila El Naggar

Lily Harwood

Lisa Servon

Luke Taylor

Lynn Patinkin

Madeleine Harrington

Marsha Tucker

Martin & Lynn Bloom

Matthew Zlatnik

Melinda Marbes

Michael & Anne Marie Mlecko

Michael & Claudine Henry

Michael & Judy Ehrlich

Michael Buckner*

Michael Friedson

Michael McLaurin

Michael Zusel

Mihai Vrasmasu

Myrna Sonora

Nancy Atherton*

Nancy Quintero

O’Keefe Smith Gift Fund

Olivia Parsons

Ophelia Gabrino

Pamela Booth

Patrick McEvoy

Patrick Peterson & Shirley Tsai

Paul & Marieta Quintero*

Paul Dominguez*

Paul Hunt*

Peter Barnett

Peter Salas

Peter, Ryan & Lila Cureton

Phyllis Hardin

Preeyel Dalal

R Katz

Rachel E McIntosh

Rahila Bashir

Ralph Tejada

Rey Cruz

Richard Clarke

Richard Yee

Rie Nomura

Robert & Faith Einhorn

Robert Kitts

Robert Mancini

Robert Moylan

Rodrigo Cerveira

Ronna Brown

Rosalba Mini

Rosanna Mason

Roshelle Nagar

Ruth Lynes

Sarah Haug

Sean Myers

Sherry & David Cook*

Shirley & Timothy Blancke

Stanley Jacobs

Stephany Rojo

Sudhir Jain

Suzanne & Paul Lipsky

Theresa Kozien

Thomas & Susana McDermott

Timothy Lynes & Jo Morningstar

Toby Edelstein

Todd Flolo*

Toni Plummer

Tyler Van Gundy

Victoria Albovias

Victoria Richardson & Max Myers*

Wendell Crawford

Wil Schweigert

William and Patricia Robbins Charitable Fund

William Blair & Co.

William Burrus

William Neri

Xiomara Peña

Zach Cox

Zoltan Csimma

* Thank you to our recurring monthly sustaining donors