Anne-Marie Saint-John, Alva, Long Island City, NY >

Financing a Small Business

According to SBA statistics, in 2016 there were almost 30 million small businesses in the U.S. alone. This figure accounts for approximately 99.7% of the total number of companies located here. If you’re the owner of a new business looking to get funding, there are lots of routes to consider. This post will providing you with a comprehensive overview of your options, along with the pros and cons of each.

Business Loans for New Companies

A host of options are available for those in the market for business loans for new companies. Picking the right type of funding is not an exact science. It depends on what sector you are in, what the loan is for, and your own personal credit circumstances.

Small Business Loans

You can apply for a small business loan from your local bank, credit union, or even a nonprofit Community Development Financial Institution (CDFI). Many online lenders also provide small business loans, but be careful of predatory terms and fees.

For many, a traditional small business loan from a bank may be out of reach, either because of limited or damaged credit, or the trading time of the business; banks typically require at least two years in business to qualify for a loan.

Community Development Financial Institutions

A CDFI is an organization that provides support and financial opportunity to people who might otherwise be unable to access loans from other, more mainstream sources. There are many reasons why a new business or small business might find it difficult to access funds:

- A poor credit rating

- Lack of credit history

- Lack of a track record or business documentation

- No collateral

- Operating or serving an economically disadvantaged community

CDFIs provide unsecured small business loan to those in the situations above, as they typically focus their efforts on the businesses that need their help most, such as sole proprietorships, unincorporated ventures, start-ups, and micro-enterprises. Besides helping to generate new jobs, the goals of CDFIs typically include supporting the local economies they serve by generating social, economic, and environmental returns.

SBA Loans

The SBA loan program is a great way to get a business loan at an attractive rate over a favorable term if you don’t qualify for traditional financing. The loan application process is known for not being the quickest way to get funding for your business. However, if you want to secure a great rate over a good term, then learning about the SBA loan program in more detail is probably a good idea. This article is a and will help you to quickly grasp the different programs they offer.

However, many new and small business owners do not currently meet the criteria for an SBA loan. Whether this is because of past credit history, insufficient collateral, or a lack of experience, there are other options when you need capital for your business.

One important factor to take into account is that a lender could request a personal guarantee from you. Lenders sometimes request a personal guarantee from a business owner seeking a loan to reduce their own level of risk. This guarantee can prove essential if you are looking to secure a high level of funding or seeking a smaller business loan.

The amount of money you need and the term will dictate the true value of this option. You also need to look at the interest rates being offered and check if there are any penalties for early settlement.

ARTICLE CONTINUED BELOW

Personal Loans

Using a personal loan for a start-up is one of the quickest and easiest ways to secure the capital you need. However, while it is a popular choice, there are lots of things to consider. As with most financing options for start-ups, you need to weigh the pros and cons in advance of applying for a personal loan to fund your business.

The Positives

More focused and committed

Putting up your own money is often a huge motivator. When you have your own money on the line, you really do everything within your power to make things work. Planning is improved, and the formation of a business plan helps to keep you on track and operate as efficiently and effectively as possible.

You have complete control

If you finance your own business, this gives you absolute control over what decisions are taken. There is nobody watching over your shoulder, there is no demand for a set return amount, and you are free to choose exactly how your money gets used. Do not underestimate the difference this can make to your business and for your sanity! The absolute control that you get for your business when your self-finance is rewarding and exceptionally compelling.

It’s more accessible for more people

If you have researched SBA loans as a way to get funding for your start-up, then you have seen the criteria that are in place for approval of those requests. It is easier to qualify for a personal loan, and a lot quicker from application to payout. Anyone who you approach for a loan for your small business will want to see your business plan, financial statements, and revenue projections.

It’s quicker and often easier

When you apply for a personal loan, there is a greater level of focus on your personal credit score and financial matters, such as income and assets. This can often mean fewer hurdles to jump when it comes to getting your loan approved.

No Collateral Required

The majority of personal loans are issued on an unsecured basis. Most Small Business Loans, however, require some form of collateral. Personal loans are ideal if you have no collateral to put forward.

The Negatives

Risks and bankruptcy

If the worst happens and the business does not succeed, then the personal funds used will need to be paid back. In some cases, this can also result in the business owner having to file for bankruptcy. Therefore, it is essential that entrepreneurs take into account this potential outcome.

Is your money going to be enough?

Running out of money or not having the bandwidth within your personal finances to support your business activities is one of the worst things that can occur. For many, getting a bank loan is often the best way to ensure you have more room for future success.

Higher interest rates

Interest rates on both business and personal loans occasionally move up and down. However, you are likely to pay a higher interest rate on a personal loan than on a small business loan. This will cost you more money and negate some of the profits you make.

Smaller borrowing capacity

The borrowing limits that come with a personal loan are typically smaller than those for loans backed by the SBA. With a general loan, a start-up could potentially receive up to $5 million. It depends on your individual start-up needs, but personal loans can sometimes fall short of the mark in terms of being able to give you the total amount that is required.

Auto Refinancing

As this article is reviewing all of the alternative sources of start-up capital, we must cover auto refinancing as one of those options. There are specific stipulations as to vehicle properties, and interest rates will typically be quite high. However, if an SBA or small business loan is not an option, this could be one way to get the funds you need for your start-up. There are a few key points to consider before you consider auto refinancing.

- If you know your credit score has improved since you applied for your original loan, then you would be eligible for a lower rate.

- Interest rates are a major factor. In 2018, as this article is being produced, interest rates are low. If you are paying 6% or higher, it could work in your favor to take this route.

If you are trying to determine the current value of your vehicle, you can do so on Autotrader.com, Edmunds.com, or KBB.com, the Kelley Blue Book website. Some lenders will not provide auto refinancing on vehicles over 7 years old; for others, it could be up to 10 years.

Getting auto refinancing on your vehicle can be straightforward and as simple as completing a form and providing some evidential ownership paperwork.

Credit Cards

If done with the right credit card at the right rate, using credit cards can be a good way to obtain short-term capital. If you have a new card, it will often come with a low introductory offer. If not, you can always call up your lender and ask if they have any offers for low interest rates. It’s important to consider the purpose of the loan. For example, when financing a piece of equipment, a term loan is a much more affordable option in the long run.

Of course, you are limited by a credit limit. However, if this isn’t an issue, then a credit card is a quick and easy option. It is important that the interest rate is low, as this will make a huge difference to how much money you have to pay back.

Also, there is a range of business and personal credit cards that offer superb cash-back schemes, many of which come with favorable introductory rates. If you need to use a credit card to make a large purchase (such as paying for shipping costs or fuel), there are a number of credit cards on the market that could offer you a cash-back value that is with taking this over a loan.

Home Equity Loans

Home equity loans are a quick and easy way to secure cash; they typically offer good terms and rates. Small business loans will not work for everyone. Understandably, when things like this happen, some business owners will turn to their largest asset to extract some cash.

In comparison to getting a loan, releasing equity in a property is quite a straightforward process. The main requirements for a home equity line are typically that you own a property and that you have both enough income to support any repayments and a good credit score.

If you are considering releasing equity in a property that you own to finance your small business, there are certain risks involved. Make sure you evaluate these risks fully to ensure this is the best way to finance your small business.

Typically, those who are in retail or own a restaurant should not opt for this type of financing for their business. Similarly, you should not use this method to finance the purchase of inventory. This is because that stock could devalue over time, becoming worth less money. However, if you provide services (for example, legal services or marketing, consulting, healthcare, or social services), the repayments take less time and will not lose their value over time.

Cash Advances

The reason I have left this option until last is because it should be the last option you consider when looking at alternative sources of start-up capital for your company. Cash advances are only useful for short-term needs, and they carry high interest rates and fees. You should exhaust all other options for funding before you consider getting a cash advance to fund your start-up.

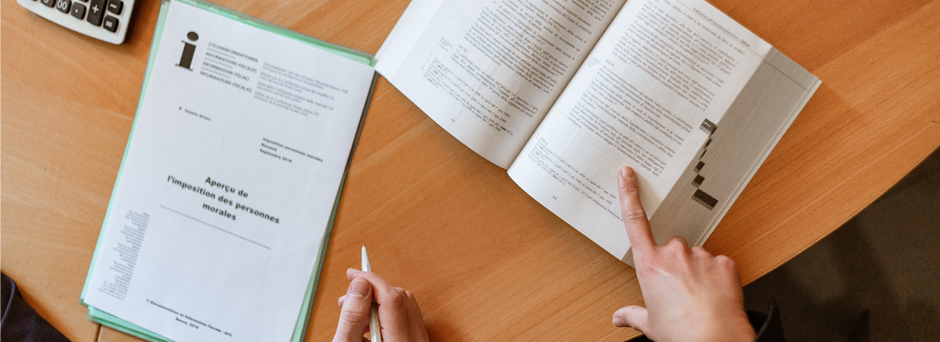

Getting Ready to Apply for a Business Loan for your Start-up

Whether your business has already launched or not, there are a number of key actions you can take to prepare yourself for the loan application process. While none of these steps will guarantee that your small business loan will be approved, they will each help your small business put its best foot forward, giving you the best chance of success.

- Write a business plan.

- Check your credit score.

- Collate your supporting paperwork.

- Consider any collateral you could use.

- Know why you need a loan and set out exactly how you intend to use the money.

- Work out how much you can realistically afford to pay back per month.

In Conclusion

There are lots of ways to finance a small business. How to Find the Right Bank to Support Your Business, and How to Write a Business Plan are two fundamental and important steps to take as you start this process. Above all else, you need to be crystal clear with your numbers, and make sure your small business marketing plan and business plan support your intended actions in their entirety.