Ascendus & Resilient: First Results Are In

Ascendus understands that in its vision to create financial ascension for all, access to capital alone is not enough. Together, we’ve worked hard over the past year to place nearly 12 million dollars of life insurance into the hands of NY based Small Business owners – at no cost to them – to help them protect both their wealth and their families.

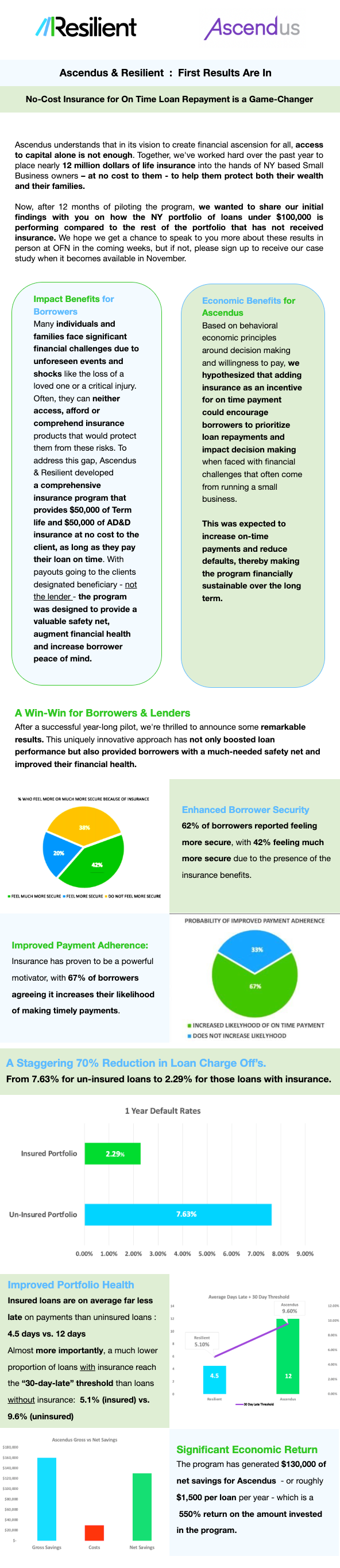

Now, after 12 months of piloting the program, we wanted to share our initial findings with you on how the NY portfolio of loans under $100,000 is performing compared to the rest of the portfolio that has not received insurance. We hope we get a chance to speak to you more about these results in person at OFN in the coming weeks, but if not, please sign up to receive our case study when it becomes available in November.

Impact Benefits for Borrowers

Many individuals and families face significant financial challenges due to unforeseen life events – like the loss of a loved one who may be the main earner.

Often, they can neither access, afford or comprehend insurance products that would protect them from these risks. To address this gap, Ascendus & Resilient developed a comprehensive insurance program that provides $50,000 of Term life and $50,000 of AD&D insurance at no cost to the client, as long as they pay their loan on time. With payouts going to the client’s designated beneficiary – not the lender – the program was designed to provide a valuable safety net, augment financial health and increase borrower peace of mind.

Economic Benefits for Ascendus

Based on behavioral economic principles around decision making and willingness to pay, we hypothesized that adding insurance as a benefit for on-time payment could encourage borrowers to prioritize loan repayments and impact decision making when faced with financial challenges that often come from running a small business.

This was expected to increase on-time payments and reduce defaults, thereby making the program financially sustainable over the long term.

A Win-Win for Borrowers & Lenders

After a successful year-long pilot, we’re thrilled to announce some remarkable results. This uniquely innovative approach has not only boosted loan performance but also provided borrowers with a much-needed safety net and improved their financial health.

Enhanced Borrower Security

62% of borrowers reported feeling more secure, with 42% feeling much more secure due to the presence of the insurance benefits.

(Pie chart showing: 42% feel much more secure, 20% feel more secure, 38% do not feel more secure)

Improved Payment Adherence

Insurance has proven to be a powerful motivator, with 67% of borrowers agreeing it increases their likelihood of making timely payments.

(Pie chart showing: 67% increased likelihood of on-time payment, 33% does not increase likelihood)

A Staggering 70% Reduction in Loan Charge Offs

From 7.63% for un-insured loans to 2.29% for those loans with insurance.

(Bar chart comparing default rates: Insured Portfolio – 2.29%, Un-Insured Portfolio – 7.63%)

Improved Portfolio Health

Insured loans are on average far less late on payments than uninsured loans: 4.5 days vs. 12 days

Almost more importantly, a much lower proportion of loans with insurance reach the “30-day-late” threshold than loans without insurance:

5.1% (insured) vs. 9.6% (uninsured)

(Chart showing average days late: Resilient – 4.5, Ascendus – 12)

Significant Economic Return

The program has generated $130,000 of net savings for Ascendus – or roughly $1,500 per loan per year – which is a 550% return on the amount invested in the program.

(Bar chart showing Ascendus Gross vs Net Savings)